Effective risk management is crucial for businesses and organizations to minimize potential threats and uncertainties. The risk management process allows companies to identify, assess, and mitigate risks that may impact their operations, finances, reputation, or strategic goals.

This article explores the key steps involved in the risk management process and highlights their significance in ensuring business resilience and success.

Risk Identification

Risk identification is the crucial first step in the risk management process. It involves systematically identifying potential risks that may affect the organization.

Here are some key aspects to consider in the risk identification process:

Internal and External Risks:

Start by considering both internal and external factors that can pose risks to the organization. Internal risks may include operational inefficiencies, employee misconduct, technology failures, or supply chain disruptions. External risks can arise from factors such as economic changes, regulatory changes, natural disasters, cybersecurity threats, or political instability.

Stakeholder Engagement:

Engage stakeholders across different levels and departments within the organization to gather their insights and perspectives on potential risks. These stakeholders can include employees, managers, executives, and subject matter experts who possess valuable knowledge about the organization’s operations and industry.

Brainstorming and Workshops:

Conduct brainstorming sessions or workshops with relevant stakeholders to generate a comprehensive list of potential risks. Encourage participants to think creatively and identify risks that may not be immediately obvious. This collaborative approach can help uncover risks that individual team members may not have considered.

Historical Data Analysis:

Analyze historical data, incident reports, and past experiences to identify recurring risks or patterns. Look for instances where risks have materialized in the past or have had a significant impact on the organization. This analysis provides valuable insights into areas that require specific attention.

Checklists and Frameworks:

Utilize checklists and risk identification frameworks to ensure a systematic approach to risk identification. These tools help ensure that no critical areas or risks are overlooked. Common frameworks include COSO Enterprise Risk Management (ERM) framework, ISO 31000 Risk Management, or industry-specific risk frameworks.

External Sources:

Stay updated on industry trends, regulatory changes, and emerging risks through external sources such as industry reports, news articles, market research, or professional networks. These sources can provide valuable information on risks that may impact the organization.

Categorization of Risks:

Categorize identified risks into different types to facilitate better understanding and management. Common risk categories include strategic risks (e.g., changes in market demand or competitor actions), operational risks (e.g., process failures or supply chain disruptions), financial risks (e.g., cash flow volatility or economic downturns), legal and regulatory risks (e.g., compliance violations or lawsuits), and reputational risks (e.g., negative media coverage or public perception).

Documentation:

Document all identified risks, along with their descriptions, potential causes, and potential impacts on the organization. This documentation serves as a reference point for further risk assessment and mitigation activities.

It is important to note that risk identification should be an ongoing process. Risks evolve and new risks may emerge over time, so regular reviews and updates of the risk identification process are essential to ensure that the organization remains prepared to address emerging threats.

By dedicating time and resources to thorough risk identification, organizations can lay a strong foundation for effective risk management processes and develop strategies to mitigate and manage potential risks successfully.

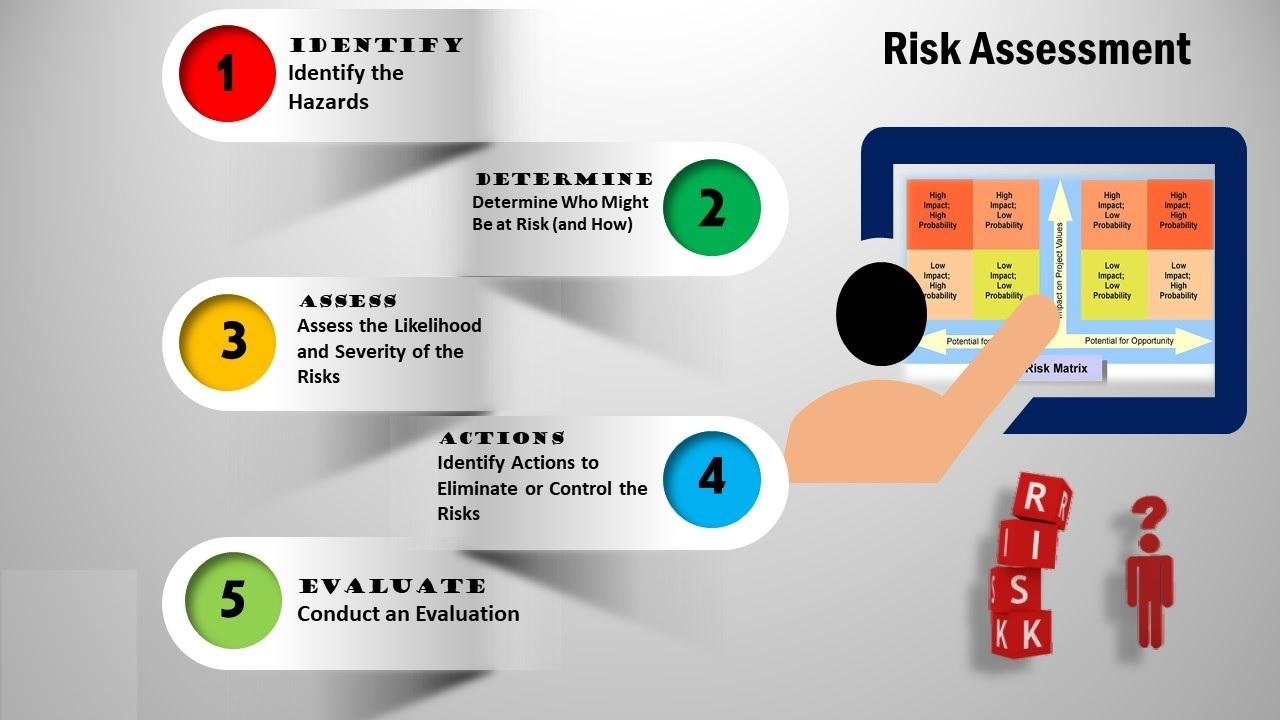

Risk Assessment

Risk assessment is a critical step in the risk management process as it involves evaluating the potential impact and likelihood of identified risks. It provides a structured approach to understanding the significance of risks and helps prioritize them for further action.

Here are key considerations for conducting a comprehensive risk assessment:

Consequence Analysis:

Assess the potential consequences or impacts of each identified risk. Consider both the immediate and long-term effects on various aspects of the organization, such as operations, finances, reputation, legal compliance, and stakeholder relationships. This analysis helps gauge the severity of each risk and its potential ramifications.

Likelihood Analysis:

Evaluate the likelihood or probability of each identified risk occurring. This assessment can be qualitative or quantitative. Qualitative analysis relies on expert judgment, experience, and historical data to subjectively assess the likelihood. Quantitative analysis involves using statistical methods and historical data to assign numerical probabilities to risks.

Both approaches help determine the likelihood of risks materializing and provide a basis for prioritizing mitigation efforts.

Risk Rating or Scoring:

Assign a risk rating or score to each identified risk based on the combination of consequence and likelihood assessments. This rating system can be numerical, such as using a scale from 1 to 5, or color-coded, such as low, medium, or high. The risk rating helps prioritize risks based on their severity, allowing the organization to allocate resources and focus on the most significant risks.

Risk Profiling:

Profile each risk by providing a detailed description of its characteristics, potential causes, and potential consequences. This profiling enhances understanding and aids in the development of targeted mitigation strategies. It also facilitates effective communication and decision-making when sharing risk information with stakeholders.

Qualitative and Quantitative Techniques:

Utilize a range of qualitative and quantitative techniques to assess risks. Qualitative techniques include risk matrices, scenario analysis, expert judgment, and Delphi method. Quantitative techniques involve statistical analysis, probabilistic modeling, simulation, or cost-benefit analysis. Combining both approaches provides a comprehensive assessment of risks.

Risk Interdependencies:

Consider the interdependencies among identified risks. Some risks may be interconnected, where the occurrence of one risk can trigger or exacerbate other risks. Understanding these interdependencies helps identify the cascading effects of risks and ensures that mitigation strategies address the holistic risk landscape.

Risk Tolerance and Thresholds:

Establish risk tolerance levels and thresholds for the organization. These are predetermined levels of acceptable risk beyond which mitigation actions must be taken. Risk assessments should compare the risk ratings against the established thresholds to determine whether the risks fall within acceptable limits or require further attention.

Documentation:

Document the results of the risk assessment, including risk ratings, profiles, and interdependencies. This documentation provides a reference for decision-making, risk communication, and ongoing monitoring and review.

By conducting a thorough risk assessment, organizations gain a deeper understanding of the potential impact and likelihood of identified risks. This enables them to prioritize their resources, develop targeted mitigation strategies, and make informed decisions about risk management activities.

Regular reassessment and updating of the risk assessment are essential to adapt to evolving risks and changing business environments.

Risk Evaluation

Explore the importance of risk evaluation in crafting a comprehensive CSR strategy. Assess potential impacts and make informed decisions for a sustainable future.

Risk evaluation is a critical step in the risk management process that involves determining the acceptability of identified risks. It focuses on comparing the assessed risks against predefined risk tolerance levels or criteria established by the organization.

Here are key considerations for conducting a thorough risk evaluation:

Risk Tolerance:

Define the organization’s risk tolerance levels, which represent the acceptable levels of risk the organization is willing to take. Risk tolerance is influenced by various factors, including the organization’s strategic objectives, financial capacity, legal and regulatory requirements, stakeholder expectations, and industry standards. It helps establish a baseline for evaluating risks and determining the appropriate risk management actions.

Risk Acceptance:

Some risks may fall within the acceptable risk tolerance levels and may be deemed acceptable without requiring specific mitigation efforts. Risk acceptance involves consciously acknowledging the risks and deciding not to implement additional risk mitigation measures. This decision is based on a careful evaluation of the risk’s potential impact, the organization’s risk appetite, cost-benefit analysis, and other relevant factors.

Risk Prioritization:

Prioritize risks based on their severity, potential impact, and alignment with organizational objectives. Risks that exceed the organization’s risk tolerance levels require further attention and mitigation efforts. Prioritization allows organizations to allocate resources effectively and address the most significant risks that could have a substantial impact on the organization’s performance and goals.

Risk Trade-offs:

During risk evaluation, it is important to consider the potential trade-offs associated with risk management decisions. Some risks may be interconnected or mutually exclusive, requiring careful analysis of the potential consequences and benefits of different risk management approaches. Trade-offs may involve evaluating the impact of mitigating one risk versus another or considering the costs associated with risk reduction strategies.

Risk Mitigation Analysis:

For risks that exceed the risk tolerance levels, evaluate and assess the potential effectiveness of different risk mitigation strategies. Conduct a cost-benefit analysis to determine the feasibility and potential impact of each mitigation option. Consider factors such as the implementation cost, resource requirements, time frame, and potential residual risks. This analysis helps in selecting the most appropriate risk mitigation measures.

Risk Communication:

Effective risk communication is essential during the risk evaluation process. Transparently communicate the evaluated risks, risk acceptance decisions, and the rationale behind those decisions to relevant stakeholders. This promotes understanding, trust, and consensus among stakeholders and ensures alignment on risk management approaches.

Documentation:

Document the results of the risk evaluation process, including the identified risks, risk prioritization, risk acceptance decisions, and trade-offs made. This documentation serves as a reference for future risk management activities, ongoing monitoring, and periodic reviews.

By conducting a thorough risk evaluation, organizations can make informed decisions regarding risk acceptance, prioritize resources for risk mitigation efforts, and ensure that risk management strategies align with the organization’s objectives and risk tolerance levels. Regular re-evaluation of risks is essential to adapt to changing circumstances, emerging risks, and evolving organizational priorities.

Risk Mitigation

Risk mitigation is a crucial step in the risk management process that involves developing strategies and implementing measures to reduce the impact or likelihood of identified risks. The objective is to proactively address risks and minimize potential harm.

Here are key considerations for effective risk mitigation:

Risk Avoidance:

Evaluate whether certain activities, processes, or strategies can be eliminated or avoided altogether to mitigate risks. Risk avoidance involves identifying and eliminating the root causes of risks or refraining from engaging in activities that pose significant risks. This approach is suitable for risks with severe potential consequences or risks that do not align with the organization’s risk tolerance levels.

Risk Transfer:

Consider transferring risks to external parties through mechanisms such as insurance, contracts, or outsourcing. Risk transfer involves shifting the financial burden or responsibility of managing risks to another entity. For example, purchasing insurance can transfer the financial risk associated with certain events to an insurance provider. Outsourcing certain functions can transfer operational risks to a specialized third-party vendor.

Risk Reduction:

Implement measures to reduce the likelihood or impact of risks. Risk reduction strategies involve implementing controls, safeguards, redundancies, or process improvements to minimize the probability of risks occurring or to mitigate their potential consequences. This may include enhancing security measures, implementing backup systems, diversifying suppliers, or implementing quality control processes.

Risk Acceptance:

For risks that fall within the acceptable risk tolerance levels and are deemed manageable, organizations may choose to accept the risks without specific mitigation efforts. Risk acceptance involves consciously acknowledging the risks and their potential impact while monitoring them to ensure they remain within acceptable limits. This approach is suitable for risks with low severity or risks that are beyond the organization’s control.

Risk Contingency Planning:

Develop contingency plans to address risks that cannot be entirely eliminated or significantly reduced. Contingency planning involves preparing alternative strategies or response actions to be implemented if a risk materializes. These plans outline specific steps, resources, and responsibilities required to mitigate the impact of risks and ensure business continuity.

Read Also: How to Become an Entrepreneur

Training and Awareness:

Promote a risk-aware culture within the organization by providing training and awareness programs to employees. Ensure that employees understand their roles and responsibilities in mitigating risks. This can include training on risk identification, reporting mechanisms, and best practices for risk management process. Well-informed and trained employees are better equipped to identify and respond to risks effectively.

Testing and Simulation:

Conduct testing and simulation exercises to assess the effectiveness of risk mitigation measures. This can involve scenario-based simulations, tabletop exercises, or stress testing of critical systems or processes. These exercises help identify any weaknesses or gaps in risk mitigation strategies and provide an opportunity to refine and strengthen them.

Regular Review and Adjustments:

Continuously review the effectiveness of risk mitigation measures and adjust strategies as needed. Risks evolve, new risks emerge, and the effectiveness of mitigation measures may change over time. The regular review ensures that risk mitigation strategies remain relevant and aligned with the organization’s objectives and risk landscape.

Documentation and Communication:

Document the risk mitigation strategies and associated plans, including roles, responsibilities, and timelines. Communicate the mitigation measures to relevant stakeholders to ensure a shared understanding and commitment to their implementation.

By implementing effective risk mitigation strategies, organizations can proactively address potential risks, reduce their impact, and enhance overall resilience. It is important to regularly assess and update risk mitigation measures to adapt to changing circumstances and emerging risks.

Risk Monitoring

Risk monitoring is a crucial step in the risk management process that involves ongoing surveillance and tracking of identified risks and their associated mitigation measures. It aims to ensure that risks are effectively managed and that the risk landscape is continuously evaluated.

Here are key considerations for effective risk monitoring:

Establish Key Risk Indicators (KRIs):

Identify and define key risk indicators specific to each identified risk. KRIs are measurable parameters or metrics that provide early warning signs of potential risk events or changes in risk levels. They serve as signals to trigger proactive risk management actions. KRIs can be financial, operational, qualitative, or quantitative in nature, depending on the nature of the risks being monitored.

Regular Data Collection and Analysis:

Continuously collect relevant data and information related to the identified risks and their associated KRIs. This can include financial reports, operational performance data, customer feedback, market trends, industry reports, incident reports, and internal audit findings. Analyze this data to assess the current risk status, identify trends, and detect any deviations from expected risk levels.

Risk Mitigation Progress Tracking:

Monitor the progress and effectiveness of implemented risk mitigation measures. Regularly assess whether the planned actions are being executed as intended and if they are achieving the desired outcomes. This includes tracking the completion of action items, assessing the impact of mitigation measures on risk levels, and evaluating whether additional actions are necessary.

Early Warning Systems:

Establish mechanisms to capture and report early warning signals of potential risks. This can involve setting up automated alerts, establishing escalation protocols, or implementing real-time monitoring systems. Early warning systems help identify risks at an early stage, allowing for timely intervention and mitigation efforts.

Regular Risk Reporting:

Develop a reporting framework to communicate risk-related information to relevant stakeholders. This includes periodic risk reports that provide updates on the status of identified risks, key risk trends, mitigation progress, and any emerging risks. Tailor the reporting format and frequency to suit the needs of different stakeholders, ensuring that the information is clear, concise, and actionable.

Risk Culture and Awareness:

Foster a risk-aware culture within the organization by promoting risk awareness and proactive risk management behaviors. Encourage employees to report potential risks or issues they observe and provide channels for open communication. Regularly communicate the importance of risk monitoring and the role that every individual plays in managing risks effectively.

Review and Adjustment:

Regularly review and reassess the identified risks, their likelihood, and potential impacts. As the business environment evolves, new risks may emerge or existing risks may change in nature. Continuously evaluate the effectiveness of risk mitigation measures and adjust strategies as needed to ensure that they remain aligned with the organization’s objectives and risk appetite.

Documentation and Record-Keeping:

Maintain comprehensive documentation of risk monitoring activities, including collected data, analysis reports, risk status updates, and any changes in risk levels. This documentation serves as a historical record and provides a basis for future risk assessments, audits, and regulatory compliance requirements.

By implementing a robust risk monitoring process, organizations can stay vigilant and responsive to potential risks. Regular monitoring allows for the timely identification of changes in risk levels, facilitates proactive risk management actions, and helps ensure that risk mitigation strategies remain effective in a dynamic business environment.

Risk Communication

Risk communication is a critical aspect of the risk management process that involves effectively conveying information about risks to stakeholders. It is essential to promote understanding, transparency, and collaboration in addressing risks.

Here are key considerations for effective risk communication:

Stakeholder Identification:

Identify the key stakeholders who need to be informed about the risks. This can include internal stakeholders such as executives, employees, and board members, as well as external stakeholders such as customers, suppliers, regulators, and the public. Consider the specific information needs and communication preferences of each stakeholder group.

Clear and Concise Messaging:

Develop clear, concise, and jargon-free messages to convey information about risks. Use language that is easily understandable by both technical and non-technical audiences. Avoid excessive technical details and focus on providing the essential information needed for stakeholders to understand the nature of the risks, their potential impact, and the organization’s mitigation strategies.

Tailored Communication:

Adapt the communication approach and style to suit the needs and preferences of different stakeholder groups. Some stakeholders may require more detailed and technical information, while others may benefit from simplified and practical explanations. Tailor the communication content, format, and frequency to ensure it is relevant and meaningful to each stakeholder group.

Two-Way Communication:

Encourage open and two-way communication with stakeholders. Provide opportunities for stakeholders to ask questions, seek clarifications, and provide feedback. Actively listen to stakeholder concerns, perspectives, and suggestions related to the risk management process. Two-way communication fosters engagement builds trust, and allows for a better understanding of stakeholder expectations and concerns.

Multi-Channel Approach:

Utilize various communication channels to reach stakeholders effectively. This can include written reports, presentations, meetings, workshops, online portals, social media platforms, and dedicated risk communication channels. Employ a mix of channels to ensure information reaches stakeholders through their preferred and accessible mediums.

Visual Aids and Infographics:

Use visual aids, infographics, and charts to present complex risk-related information in a visually appealing and easily understandable format. Visual representations can help stakeholders grasp key concepts, trends, and interdependencies more quickly and effectively. This is particularly useful when communicating risk assessments, risk profiles, and mitigation progress.

Timely and Proactive Communication:

Communicate risk-related information in a timely and proactive manner. Keep stakeholders informed about the progress of risk mitigation efforts, any changes in risk levels, emerging risks, and relevant regulatory updates. Timely communication enables stakeholders to stay informed and make well-informed decisions related to the risks.

Consistency and Continuity:

Ensure consistency in risk communication messages across different channels and over time. Consistent messaging helps avoid confusion and ensures that stakeholders receive a unified understanding of the risks and risk management efforts. Continuously communicate updates and progress to maintain stakeholders’ attention and commitment to the risk management process.

Training and Education:

Provide training and educational resources to stakeholders to enhance their understanding of risk management concepts, terminology, and best practices. This can include workshops, webinars, online modules, and informative materials. Well-informed stakeholders are better equipped to contribute to risk management efforts and make informed decisions.

Effective risk communication is essential for engaging stakeholders, building trust, and fostering a proactive risk management culture within the organization. By communicating risks clearly and transparently, organizations can align stakeholder expectations, gain support for risk mitigation measures, and enhance overall risk resilience.

Risk Review and Continuous Improvement

Risk review and continuous improvement are integral components of the risk management process. They involve regular assessments, evaluations, and adjustments to ensure that the risk management efforts remain effective and aligned with the evolving risk landscape.

Here are key considerations for risk review and continuous improvement:

Periodic Risk Assessments:

Conduct periodic risk assessments to reassess the identified risks, their likelihood, and potential impacts. This involves reviewing the existing risk register, collecting updated data and information, and analyzing the current risk landscape. Periodic assessments help identify new risks, changes in risk levels, and potential gaps in the risk management process.

Lessons Learned Analysis:

Review and analyze past risk events, incidents, and near misses to extract lessons learned. Identify any weaknesses or deficiencies in the risk management process that contributed to the occurrence or severity of the events. Use these insights to improve risk identification, assessment, mitigation, and monitoring strategies.

Key Performance Indicators (KPIs):

Define and track key performance indicators to measure the effectiveness of risk management efforts. These KPIs can include metrics such as the number of identified risks, risk mitigation completion rates, risk reduction levels, incident frequency and severity, and stakeholder satisfaction with risk management processes. Regularly monitor and analyze KPIs to identify areas for improvement and measure progress over time.

Feedback and Input:

Seek feedback and input from stakeholders on the effectiveness of risk management processes. Engage with stakeholders through surveys, interviews, workshops, and other feedback mechanisms to gather their perspectives, suggestions, and concerns. Incorporate stakeholder feedback into the risk review process to ensure that the risk management approach reflects their expectations and requirements.

Continuous Risk Monitoring:

Continuously monitor the identified risks and the effectiveness of risk mitigation measures. Implement real-time monitoring systems, collect relevant data, and analyze the risk indicators to detect any changes or emerging risks. Regularly communicate risk updates to stakeholders to keep them informed and maintain their engagement in risk management activities.

Risk Management Culture:

Foster a risk-aware culture within the organization that encourages continuous improvement. Promote open communication, knowledge sharing, and collaboration among employees to facilitate the identification of potential risks and improvement opportunities. Empower employees to contribute to risk management efforts and provide mechanisms for them to propose risk mitigation ideas.

Review of Risk Appetite and Tolerance:

Regularly review and reassess the organization’s risk appetite and tolerance levels. Consider changes in business objectives, market conditions, regulations, and stakeholder expectations. Adjust risk tolerance levels if necessary to ensure they align with the organization’s risk management strategy and overall risk profile.

Documentation and Reporting:

Document the outcomes of risk review activities, including findings, recommendations, and action plans. Maintain a record of risk assessments, lessons learned, and improvement initiatives. Develop periodic risk review reports to communicate the results and progress of risk management efforts to relevant stakeholders.

Continuous Learning and Training:

Foster a culture of continuous learning and provide ongoing training and development opportunities for employees involved in the risk management process. Stay updated with the latest industry trends, best practices, and regulatory requirements. Regularly review and enhance risk management training programs to address emerging risks and improve risk management competencies within the organization.

By conducting regular risk reviews and implementing continuous improvement measures, organizations can adapt to changing risk landscapes, enhance the effectiveness of risk management strategies, and maintain resilience in the face of evolving risks. The goal is to foster a culture of continuous learning and improvement, where risk management becomes an integral part of everyday decision-making processes.

Conclusion

The risk management process plays a crucial role in safeguarding businesses and organizations from potential risks. By following the key steps of risk identification, assessment, evaluation, mitigation, monitoring, communication, and review, organizations can proactively manage risks and ensure business continuity.

Implementing a robust risk management process helps organizations build resilience, protect their reputation, enhance decision-making, and create a competitive advantage in today’s dynamic and uncertain business landscape. With effective risk management practices in place, organizations are better equipped to navigate challenges, capitalize on opportunities, and achieve long-term success.